The Kam Financial & Realty, Inc. Statements

Table of ContentsThe 9-Minute Rule for Kam Financial & Realty, Inc.The Only Guide for Kam Financial & Realty, Inc.Not known Incorrect Statements About Kam Financial & Realty, Inc. Kam Financial & Realty, Inc. Fundamentals ExplainedSome Known Questions About Kam Financial & Realty, Inc..Kam Financial & Realty, Inc. Things To Know Before You Buy

When one thinks about that home loan brokers are not needed to file SARs, the actual quantity of home mortgage scams activity could be a lot greater. (https://www.giantbomb.com/profile/kamfnnclr1ty/). Since early March 2007, the Federal Bureau of Investigation (FBI) had 1,036 pending mortgage scams examinations,4 compared to 818 and 721, specifically, in both previous yearsThe bulk of home mortgage fraud falls under 2 wide groups based on the inspiration behind the scams. typically includes a consumer who will overemphasize income or possession worths on his/her financial statement to qualify for a loan to purchase a home (mortgage lenders in california). In a lot of these instances, assumptions are that if the revenue does not increase to meet the settlement, the home will be cost a benefit from gratitude

A Biased View of Kam Financial & Realty, Inc.

The large majority of scams instances are found and reported by the institutions themselves. Broker-facilitated scams can be scams for building, fraud for earnings, or a combination of both.

A $165 million neighborhood financial institution made a decision to go into the mortgage banking company. The bank purchased a small home loan business and worked with a skilled home mortgage banker to run the procedure.

More About Kam Financial & Realty, Inc.

The bank alerted its main federal regulator, which then got in touch with the FDIC due to the prospective influence on the bank's financial condition ((https://sandbox.zenodo.org/records/137781). Additional investigation exposed that the broker was operating in collusion with a building contractor and an evaluator to turn properties over and over once more for higher, invalid revenues. In overall, greater than 100 financings were stemmed to one building contractor in the same neighborhood

The broker rejected to make the payments, and the case went right into lawsuits. The bank was at some point granted $3.5 million. In a succeeding discussion with FDIC supervisors, the financial institution's president indicated that he had news always listened to that one of the most tough part of home mortgage banking was seeing to it you carried out the ideal bush to offset any kind of passion rate risk the bank might incur while warehousing a significant quantity of home loan fundings.

Kam Financial & Realty, Inc. - Questions

The bank had depiction and guarantee clauses in contracts with its brokers and thought it had option with regard to the car loans being originated and marketed through the pipeline. During the litigation, the third-party broker suggested that the bank must share some duty for this exposure due to the fact that its internal control systems ought to have recognized a financing concentration to this one community and set up actions to prevent this risk.

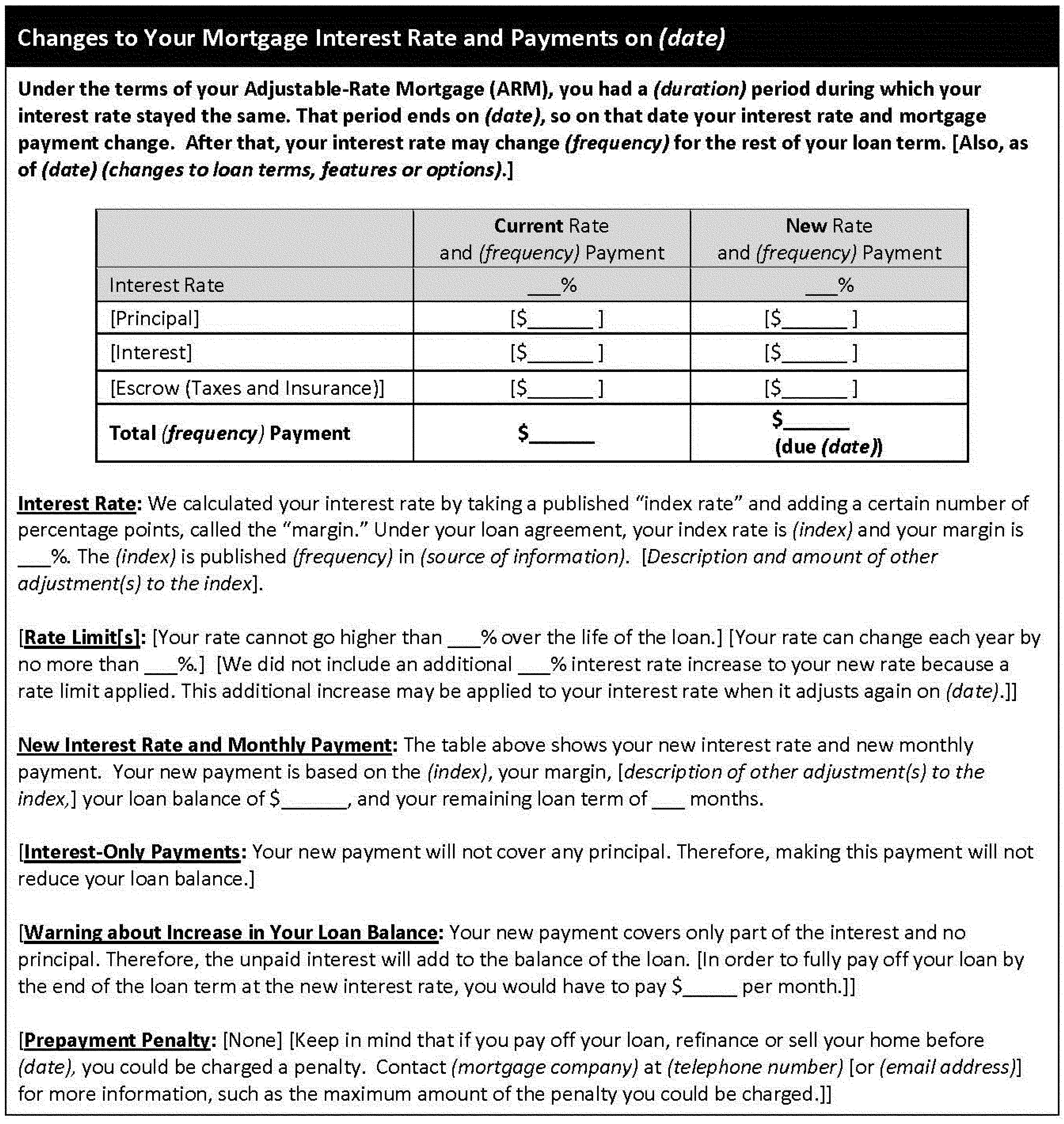

So, to get a far better hold on what the hell you're paying, why you're paying it, and for how much time, allow's damage down a common monthly home mortgage settlement. Do not be tricked here. What we call a regular monthly home loan repayment isn't just settling your home mortgage. Rather, assume of a regular monthly mortgage repayment as the four horsemen: Principal, Interest, Property Tax Obligation, and House owner's Insurance policy (called PITIlike pity, because, you recognize, it boosts your settlement).

Hang onif you believe principal is the only amount to consider, you would certainly be failing to remember concerning principal's best pal: passion. It would certainly behave to assume loan providers let you obtain their cash simply because they like you. While that may be real, they're still running an organization and intend to put food on the table as well.

Examine This Report about Kam Financial & Realty, Inc.

Rate of interest is a percent of the principalthe amount of the financing you have delegated settle. Interest is a percentage of the principalthe amount of the funding you have actually left to pay back. Home loan rates of interest are constantly altering, which is why it's clever to choose a home loan with a fixed interest rate so you know how much you'll pay monthly.

That would certainly suggest you would certainly pay a tremendous $533 on your very first month's home loan payment. Obtain all set for a little bit of math here.

How Kam Financial & Realty, Inc. can Save You Time, Stress, and Money.

That would make your regular monthly mortgage repayment $1,184 monthly. Month-to-month Principal $1,184 $533 $651 The next month, you'll pay the exact same $1,184, but less will certainly go to passion ($531) and much more will go to your principal ($653). That fad continues over the life of your home mortgage until, by the end of your home mortgage, almost all of your payment goes toward principal.